I am a retired farmer of 75 years who has given up his rented land but still owns 150 acres (now used by sons) along with a farmhouse and buildings. As result of the recent proposal to only shelter the first £1million of agricultural land from the tax as opposed to a limitless allowance, I find myself, when other allowances are added in, being over the threshold.

My reaction has been to start the process of gifting some land to my sons and hope to live for seven years after the conveyance is complete. On the face of it this is an option open to all farmers and therefore ‘job done’. However, if there is a substantial mortgage or other loans on the property as a whole, the lender will have the final say. Depending on how much land the farmer wants to gift away, the lender must be content that what remains will be an adequate security for the loan. In many cases the lender will object or want to the farmer to reduce the value of the gift. Of course, a really hefty mortgage will devalue the inheritance.

It could be argued that if the present farmer received the land as a gift, then there would be no mortgage. But this overlooks the fact that to stay as a viable unit in today’s agriculture, farms have had to intensify their operations requiring very large investments in plant and equipment. These items become ‘stranded assets’ the day they are installed, and lenders require other security, such as land, to finance this equipment at an acceptable cost.

Under the previous tax regime, the death of a farmer, whilst inflicting a personal trauma on the family, did not imply the death of the business. To be fairly brutal it would mean one less individual taking a living wage from the business with the bonus of the pay out of a life assurance policy. The term ‘wage’ brings up the next point. The younger generation will have taken very modest drawings off a family partnership, considerably less than their efforts would have justified in the knowledge that “one day son all this will be yours.” The rug is now pulled from under their feet as they have to contemplate the spectre of having to pay off a tax demand of £1 million over ten years out of business profits. The new rule will persuade many of the younger generation to liquidate the business and try to find other employment.

Farmland is worth far more than its productive capacity for four reasons. Neighbouring farmers will bust a gut to buy an adjoining field, the opportunity may only occur once in a lifetime. They will spread the cost over the whole business and think very long term.

Good Lifers will bid up for equestrian and amenity purposes.

A farmer who has been fortunate to sell a small area for development, will seek to protect himself from Capital Gains Tax by rolling over proceeds into agricultural land, and he has a deep pocket.

Men or women who have built up substantial commercial or industrial businesses and wish to sell up, knowing that if they invest the proceeds into agricultural land, they will only have to let it out on a Farm Business Tenancy for two years, after which their children can inherit free of Inheritance Tax. They take this tax avoidance strategy a stage further by buying blocks of land here and there, each block being below the threshold for stamp duty.

This last factor will indeed be hit by the new rules but could be easily extinguished without plundering tax from small family farms. I support the suggestion that Inheritance tax could be rolled forward if the inheritor continued to farm the land they had taken a livelihood from (over a given number of years). If the inheritor decides to sell a few years down the track, then he is liable for IHT.

Land values will drop as a result of this tax, meaning that the tax raised will be less, and the land more affordable for new entrants. However, if it drops too far, then heavily borrowed farm businesses may find themselves falling into negative equity. It gets complicated….!

Many commentators are claiming that this new levy of IHT will cause a large sell-off of land thus devastating food production. I just do not buy this at all. The land has not disappeared, it has not lost its productive value, it has not been prohibited from agricultural activities. It will settle to a value where an entrepreneurial farmer believes he can finance the farming of it, selling its produce to a rising population of British consumers.

Nevertheless, land IS being removed from agriculture, and it is nothing to do with IHT. It is a direct consequence of the Net Zero madness where corporations whose activities emit CO2, purchase land on which to plant trees. These growing trees will obligingly suck up CO2 and then re-emit ALL of it when they rot or are burnt.

Net Zero is grabbing arable land in another way in the form of solar arrays. Whilst these prevent cropping, they do allow sheep grazing. I have personal experience of grazing sheep under panels, having been awarded the right to do so locally. There are problems as well as advantages. Whilst the sheep trade remains so strong, (for which I have to thank the rapidly rising Muslim population), then grassland under solar panels does help feed the nation.

Net Zero is a reaction to the theory that if we reduce the quantity of CO2 and other greenhouse gases into the atmosphere, then the world’s weather will improve. I am one of those who profoundly disagree, but that is another debate.

Meanwhile farmers are being told to change their farming practices to reduce emissions of greenhouse gases which is where the Green Lobby who are pushing for this, get themselves into a mire of hypocrisy and contradiction.

Of the five main GHGs, farming emits four: CO2; Methane; Nitrous Oxide and Water vapour.

CO2 is emitted from farms via rotting crop residues and the use of combustion engines. Whilst the CO2 from the rotting vegetation is cancelled out by the absorption of CO2 as those crops were growing, the tractors are net emitters. However, an increase of CO2 in the atmosphere causes our crops to grow faster. Indeed, this is recognised by glasshouse growers who introduce CO2 into their glasshouses for this very purpose with an economic response from as much as 1200ppm (up from 400ppm).

The Green Lobby assume that the greater the concentration of CO2 in the atmosphere, then the greater the ‘greenhouse’ effect. This is true at the lower levels of CO2, but with each incremental addition of CO2, the increase in the greenhouse effect is reduced. After CO2 has reached 250 ppm of the atmosphere, there is virtually no increase in the greenhouse properties. We are now at about 400ppm, so farmers and others are going to remove 150 ppm for no benefit whatsoever if that can even be achieved. If it is achieved, then crops will grow more slowly.

The Green lobby want to see reduced tractor use, particularly in high horsepower cultivations. Big reductions are possible if farmers grow GM crops. However, the Green Lobby hate GM crops.

The Green Lobby want more well managed hedgerows on farms to ‘trap emissions’ However a well-managed hedge can be defined as a double row of hedge plants that are allowed to grow to approx. three metres high and then trimmed twice in five years at slightly different heights each trimming. The fallen trimmings will rot and re-emit their CO2 whilst the fuel used by the tractor powered hedge trimmer will cause the hedge to be a net carbon emitter!

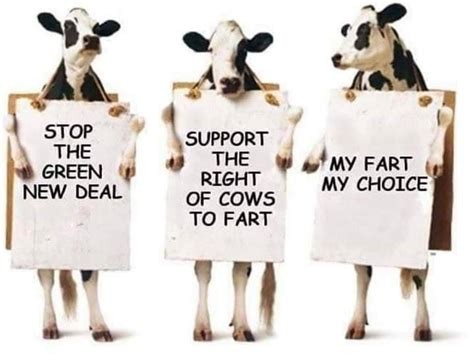

Methane is emitted in large quantities by farm ruminants contributing to the 1.7 parts per million found in the atmosphere. ALL this Methane is in a state of breakdown that takes about 12 years to complete. Thus the concentration remains at a stable level providing an essential greenhouse gas to keep our planet habitable.

The expansion of farm ruminants in the last two thousand years has been roughly matched by the decreases in the huge herds of different ruminants that roamed America, Europe, Asia and Africa for millennia. Nevertheless, the Green Lobby insist that farmers feed their ruminants diets that result in less methane. Perversely this can be achieved by feeding expensive grain, instead of grazed grass. But wait a minute, this grain will have a ‘carbon footprint’ of its own in its production and transport!

Still undeterred, the Green Lobby want farmers to breed from animals that happen to produce less Methane than average. Efforts have to be made to measure such emissions from each end of the animal. A smelly job, but it can be done. What the Green Lobby don’t seem to appreciate is that less Methane means less digestion and ergo a poorer performing animal. It will simply emit less methane per day but take more days to reach the market. So very little is achieved. Exactly the opposite to what the farmer wants.

Nitrous Oxide at 0.3 ppm this is indeed a trace gas. Farmers produce it in two ways:

1) The use of manufactured Nitrogen fertiliser. This can be reduced but means lower yields and the subsequent ‘carbon footprint’ of other food produced to fill the gap. Modern plant breeding methods such as GM and Gene Editing can genuinely reduce the quantity of N needed by a crop, But the Green Lobby hate these endeavours.

2) Emissions from leguminous crops such as peas and beans (a relatively small acreage), but crucially from clover found in most of the grassland that covers 60% of our farmed area. The Green Lobby love clover, which is the backbone to organic farming. A right conundrum!

Water Vapour is the highly effective greenhouse gas that has a very noticeable effect on our climate. It is represented by cloud cover in the sky and, as such, sets the agenda for the weather we can expect. It is found in far higher quantities than the other GHGs. It is unstable and displaces other gases where it occurs. Yet the Green Lobby just does not want to talk about it. Which is hardly surprising as even they understand that rainfall is essential. Farming emits Water Vapour from crops and grass in the form of transpiration which can only be curtailed by a serious drought. But aren’t droughts the things that Net Zero is supposed to prevent?

The fifth Greenhouse gas: Ozone, is not produced by agriculture. Human activity (CFCs in aerosols) has actually caused it to reduce in our atmosphere. This reduction in a GHG has actually had negative consequences in the form of skin conditions resulting from exposure to sunshine.

Whilst farmers have a duty to minimise environmental pollution, they must never be expected to improve the world’s weather.

STUART AGNEW