Before proceeding, I must confess that I have little idea on how to hide wealth from greedy dictators or how to outfox autocrats as suggested in the headline. In fact, the headline could, and probably should, have been ‘How Do I Hide My Money from Greedy Dictators: Please Guide Me on How to Outfox Autocrats and Keep my Wealth Safe”. So please, if you have financial nous, pile in and tell us what you think we should do.

I take it as self-evident that it is now a citizen’s patriotic and moral duty to shield wealth from the autocratic, kleptocratic and alien State under which we now suffer. The contract between ruled and rulers is well and truly broken, and in my opinion, this government – like the last – has power but no legitimacy, no democratic mandate or popular support for its actions, and is not even attempting to govern for the benefit of the British people, the largest section of which it obviously hates.

It follows therefore that the current regime will, like its fellow globalist Tory predecessor, attempt a transfer of wealth from the British people to the Globalist Blob that controls it; the wealthy Net Zero rent seekers and parasites, charity bosses, quangocrats, foreigners here and abroad and, of course, its fellow travellers in the civil service, trade unions and the public sector.

To do this it will attack our wealth, overtly and covertly, in the form of taxation, freezing tax threshold allowances, rules and regulations, inflation, fines – anything they can think of to separate you from your wealth and property. The State is now the Boss, and it is clear that it thinks that you and everything you have belongs to it, following the dictum of fellow socialist Benito Mussolini: “Everything Within the State, Nothing Against the State, Nothing Outside the State.”

Every penny you shield from them is a penny less that they can spend destroying our country. They do not care what you think. The know that they have our ‘democracy’ stitched up; getting their hands on your money is all they care about. They are serious when they say by 2030 you will own nothing so the time to do something is now. Inertia might well be very expensive

At every stage of financial planning a key consideration must be that the State cannot be trusted. Bear this in mind, especially if following the standard financial advice given in the MSM, as it is all based on the assumption of a degree of trust that the State has some checks on it and that, although the government might change the rules a bit, nothing huge is in the pipeline.

But huge changes are in the pipeline; the growth of State power, global tax harmonisation and increases, more financial regulation and, especially, the Central Bank Digital Currencies that governments around the world are planning, all making financial planning very difficult and beyond the capability or pocket of most people, including me.

Starting with the certainty of tax rises, under the current autocratic quasi-fascist Labour regime, it is a case of when and how much, not if. Throughout Labour’s highly mendacious and evasive general election campaign, party apparatchiks stressed that they had “no plans” to increase taxes beyond their stated manifesto pledges, but on achieving office they invented the outrageous lie that they had suddenly discovered a £20bn black hole in the nation’s finances.

Labour’s election victory was secured in part, from a very reluctant electorate, by pledging not to increase income tax, national insurance, VAT or corporation tax — the “big four” accounting for about 75 per cent of the annual tax take, though it seems that they are likely to increase corporation tax, thus putting more businesses under stress, reducing investment and employment, though no doubt compensated for by the importation of ever more cheap labour.

Second-guessing changes to tax rules is a risky business at the best of times, and higher earner, the relatively well-off, and the retired should seriously weigh the risks of pre-emptive action against the rewards of lower tax bills in future.

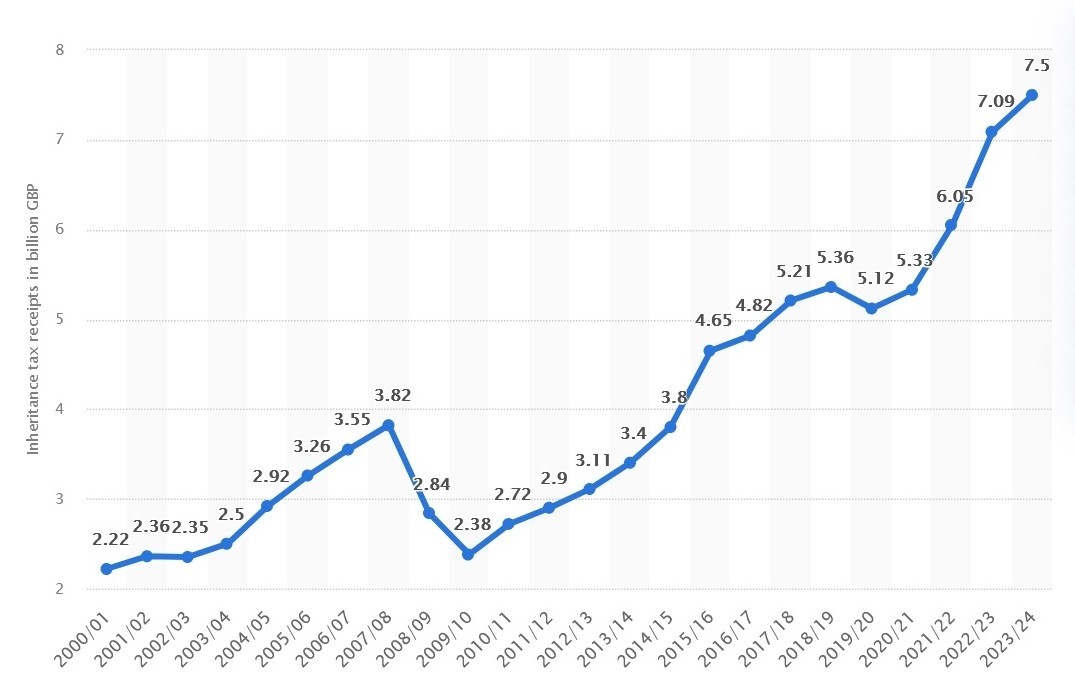

Other than leaving the country – and finding a place you might like that isn’t as bad is not easy – and even if you go you could easily still be liable for UK taxation, especially the eggregious act of theft known as inheritance tax (IHT), there are several financial matters that need to be looked at to “Labour-proof” our finances against possible future tax rises.

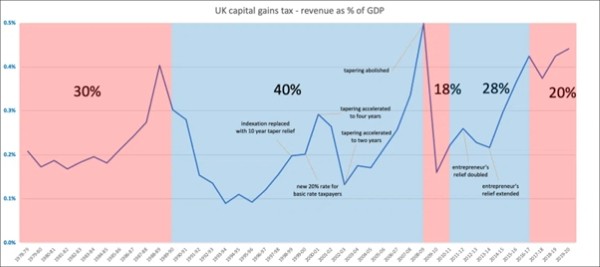

Tinkering with capital gains tax (CGT) is a way of levying a wealth tax by another name. Gains on investments held outside pensions and Isas are taxed at 20 per cent: historically low for the UK, and relatively low compared to the US and Europe. The fear is that the Labour regime will increase CGT rates to align them with rates charged on dividends or income tax.

Obviously, when CGT is about to go up people accelerate sales to benefit from the current lower rate; the system, which has no allowance for inflation is therefore irrational in that it punishes long-term investment. Worryingly, as the chart shows, though CGT is high, it was higher when Labour was last in power.

Now if you are a big corporation, you will probably have arranged to have large allowable tax losses that can be used to offset capital gains. This is harder for the rest of us to finagle, but it might be worth thinking about, depending on circumstances. I’m not yet sure if this strategy is available to individuals, perhaps with buy-to-let property, but if so, you can store up allowable losses to use if CGT rates rise in future – unless Labour puts a time limit on them, or caps capital loss allowances.

Transferring assets to a spouse can be an effective way to maximise the use of both partners’ CGT allowance.

People with shares should look at their investment portfolios and, before the budget, consider selling and immediately purchasing similar shares so that the current capital gains tax rate is banked. But note that it has to be in different shares because of the tax rules, which negate this form of planning if the same shares are repurchased within 30 days of sale.

So far, ISAs remain outside the scope of CGT, so if you haven’t done so this year, use up your £20,000 annual allowance, as well as your spouse's.

When it comes to investment properties, the fear of a future CGT increase is adding to financial pressures facing smaller buy-to-let landlords, many of whom are opting to sell up. CGT is charged at 24 per cent for higher rate taxpayers selling second homes or buy-to-let property. It is of less concern for larger corporate landlords, who are piling into the rental market and who usually hold rental properties within corporate structures. If you are thinking of incorporating investment properties, you need to understand that the Tax Mob considers this to be both a sale and a purchase, taxing you at both ends.

One bit of wishful thinking from me is that, with all the talk of future CGT rises, asset owners spooked into selling up will swell the kleptocrats’ coffers and thus diminish their greed. About as likely as a chocolate teapot I know, but there’s always hope.

The other financial vehicle that we need to look at, is pensions. Some MSM ‘experts’ are currently advising folk to spend the money inside a pension instead of regarding as as their children’s inheritance but be careful. Ending the favourable inheritance tax treatment of defined contribution pensions is an easy target for a rapacious regime that obviously considers pensioners as an enemy to be frozen. We should not forget Brown’s evil pension raids, which resulted in a massive transfer of wealth away from those that created it, to underserving Labour layabouts. But taking money out of a pension exposes it to other taxes.

Reiver Reeves has a lot of choices when it comes to pensions. She can end the tax-free lump sums, the higher rate tax relief or bringing forward increases to the state pension age — we should be deeply worried about all of them.

Possibly, those who can, should draw down the tax free 25% before the budget – but that leaves you with the question of what to do with the money. If you have a good reason and something positive to do with it, like paying off a mortgage or funding your children’s property deposits, you should do so. But to put to bring it inside your estate for tax purposes by putting it in the bank or in a general investment account at risk of future CGT, might not be a good idea.

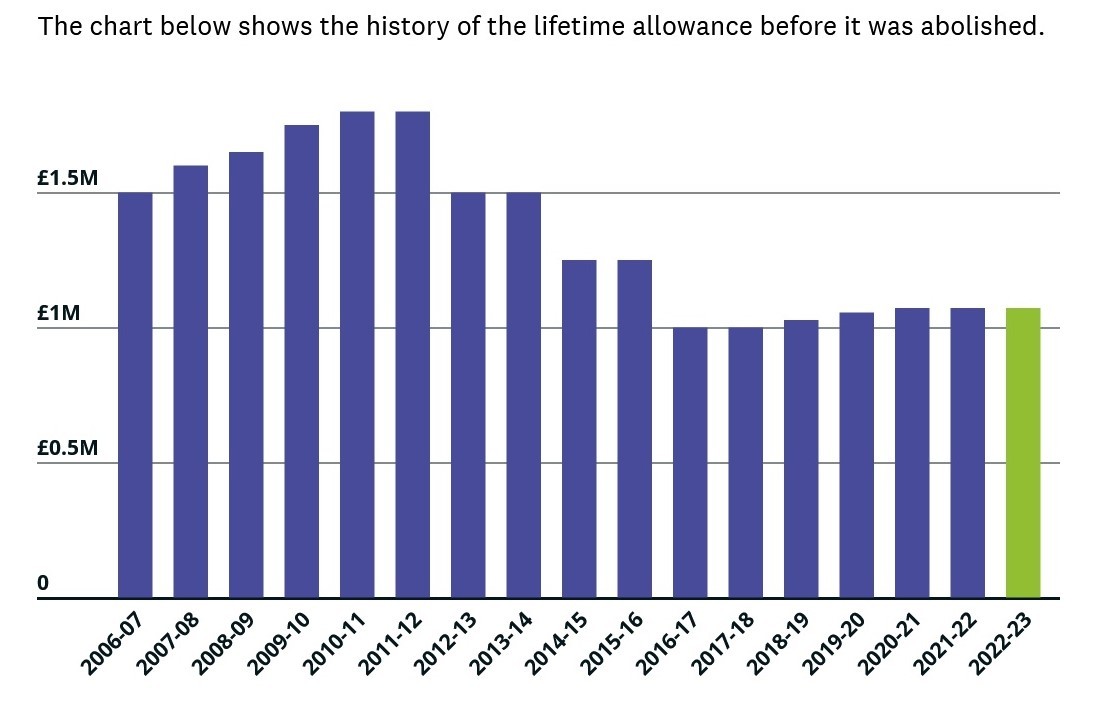

As many will know, the lifetime allowance (LTA) was scrapped, and Labour’s manifesto indicated that it will not be reinstated, but who trusts them? As the general feeling within Labours ranks is that pensions tax relief is “too favourable to the ‘rich’ – a group that is never defined –it would be no surprise if the higher rate relief was also attacked.

With many feeling the effects of fiscal drag, making additional pensions contributions to reduce income tax paid is an efficient strategy – but watch out for changes.

Advisers have long encouraged “giving while living” to reduce inheritance tax bills and start the seven-year clock ticking on potentially exempt transfers. Political change has added a new urgency and many have been accelerating the transfer of assets to younger generations, out of fear of changes to IHT under a Labour government, as it is quite likely that any ‘tidying up’ of the rules could make it less advantageous to inherit a pension, or could remove business property relief on certain Aim-listed shares when held for more than two years — a common, if risky, tactic used to reduce IHT bills.

One option, an insurance policy to hedge future IHT liabilities, is increasingly common strategy if you’re in your 50s or 60s and in good health. Taking out whole of life cover to provide the liquidity needed to settle the eventual tax bill can be very cost effective, though it is not clear how much this would cost.

At any rate, we need to understand that probate cannot be granted until IHT bills are paid, and if your beneficiaries are set to inherit a large, illiquid estate with a lot of property or carried interest, they may struggle to do so.

Another option is to set up pensions for children and grandchildren. Up to £2,880 per year can be invested, topped up to £3,600 with 20 per cent tax relief, and cannot be accessed until they reach retirement age, so the power of compounding should be very effective.

It might also be worth looking at setting up a family investment company. Family members become shareholders, and can then be paid dividends, which could be a tax efficient way of covering expenses of children or grandchildren at university, who should be subject to a low tax rate on their dividends.

The use of tax deferral vehicles such as offshore bond portfolios is also an option, as they are subject to the income tax rate of the person who receives the income, gifting a segment to a child at university is a good move. (Bear in mind the upfront charges and advisory fees for setting up these structures.)

Many advisors rattle on about avoiding CGT by donating to charity. Charities are permitted to dispose of shares free of capital gains. While they cannot claim Gift Aid on the value of the donation, individuals can offset the gross value of the gift against income tax, but as nearly all charities are now part of the globalist blob, donating to them is, in my view, as bad as letting the State getting its rapacious hands on your money.

Gifts to spouses or civil partners are completely free of IHT and each tax year you can also give away up to £3,000 worth of gifts with your annual exemption. This means couples can gift £6,000 a year. In addition, there is no limit on excess income - above expenditure - that can be gifted.

School fees — grandparents to the rescue? Thieving Reiver Reeves has said she would not introduce the proposed changes for boarding and day schools until next year, meaning measures will not be in place for the beginning of the school term in September. But who believes anything she says? Changes could be scheduled for as early as the Easter break in April 2025.

In response private schools have reacted by advertising advance payment schemes to get ahead of any VAT introduction. But beware, these may not escape the impact of the proposals as there is still the prospect of a challenge by HM Revenue & Customs, as payments could be considered a deposit rather than an advance payment.

But just possibly, grandparents who help their children with fees might also be able to benefit from inheritance tax advantages. Grandparents can gift from surplus income — cash left over after normal day-to-day living costs — without counting towards a person’s £325,000 nil rate band.

For those making gifts from investments as well as income, a bare trust set up in the beneficiary’s name may be an attractive route as investment income is taxed against the grandchild’s personal income tax allowance.

The recipient of a bare trust also benefits from their annual £3,000 capital gains tax exemption. A grandparent making an irrevocable gift to the bare trust will trigger the seven-year clock.

Those individuals who are less clear on the potential beneficiary can set up a discretionary trust where funds can be dispersed with more control and will count towards the nil rate band for inheritance tax purposes.

Time to consider leaving the country? Non-doms are said to be increasingly considering whether to leave the UK, with many emigrating, spooked by Labour’s position that it would remove their ability to shield foreign assets held in a trust permanently from inheritance tax.

Others report that people are choosing to become non-UK tax resident by increasing the number of days they spend outside the country. Depending on factors such as family ties and location of residences, this means they can still retain a home in the UK and spend a limited amount of time here. But they should beware, as HMRC sets the bar very high for this, and leaving the smallest asset here can trigger tax claims.

I know a couple who moved to France, but on the death of the husband after a couple of years, his widow found that IHT is even higher there, and, because they had a buy-to-let property in England, she was also hit by an IHT claim from the HMRC. I don’t know how it all worked out in the end.

For those still working, making a pension contribution is the single most straightforward way to reduce your income tax exposure, whether that is through a personal contribution or asking your employer to add to your pension in lieu of a pay rise or bonus, a process dubbed ‘salary sacrifice’.

Basic-rate taxpayers currently get 20% tax relief on pension contributions, higher-rate taxpayers benefit from 40%, and additional-rate taxpayers get 45% relief, though as stated above, Labour could change this.

Other ideas I’m looking at but either do not fully understand yet or am very cautious about are the Enterprise Investment Scheme, Discounted Gift Trusts (that allows you to put a lump sum into trust while retaining the right to receive regular payments and the value of the initial gift may be discounted for IHT purposes), gold, silver, jewellery and crypto.

Depending on the reaction this article I might follow it up with more on these after I complete my research later later this week. Let me know if this is of interest.

As will be apparent, I’m far from expert on financial matters and this article reflects my inexpert first attempt to master a subject I’ve been putting off for years. I suppose I owe the thieves in government a grudging thanks for stirring me out of my inertia.