Iain Hunter, in his excellent article on the mess the Establishment has made of our country, refers to British governance as a Kleptocratic Kakistocracy. That, in my view, is hard to deny.

We all know that Kleptocracy is a form of government where the leaders steal money and resources from their country, and we all know that our lunatic ‘leaders’ do just that, but to be certain, I looked up the etymology of kakistocracy, now meaning ‘government under the control of a nation's worst or least-qualified people’ and was unsurprised to learn that it has Greek roots: kakistos "worst," possibly related to the Proto-Indo-European root kakka- "to defecate" (and still used this way in proto-Indo-European North East England). Sounds apt.

And our Kleptomaniac Kakistocrats (KKK – the last K is left to your imagination) are just getting started, wanting ever more of our money. I take it as axiomatic that it is the bounden duty of all patriotic people to keep as much of their money out of the hands of the malevolent Establishment as they possibly can. I discussed some (legal) options in my article How to Hide Your Wealth From Greedy Dictators. In this article I discuss (legal) options for minimising inheritance tax (IHT).

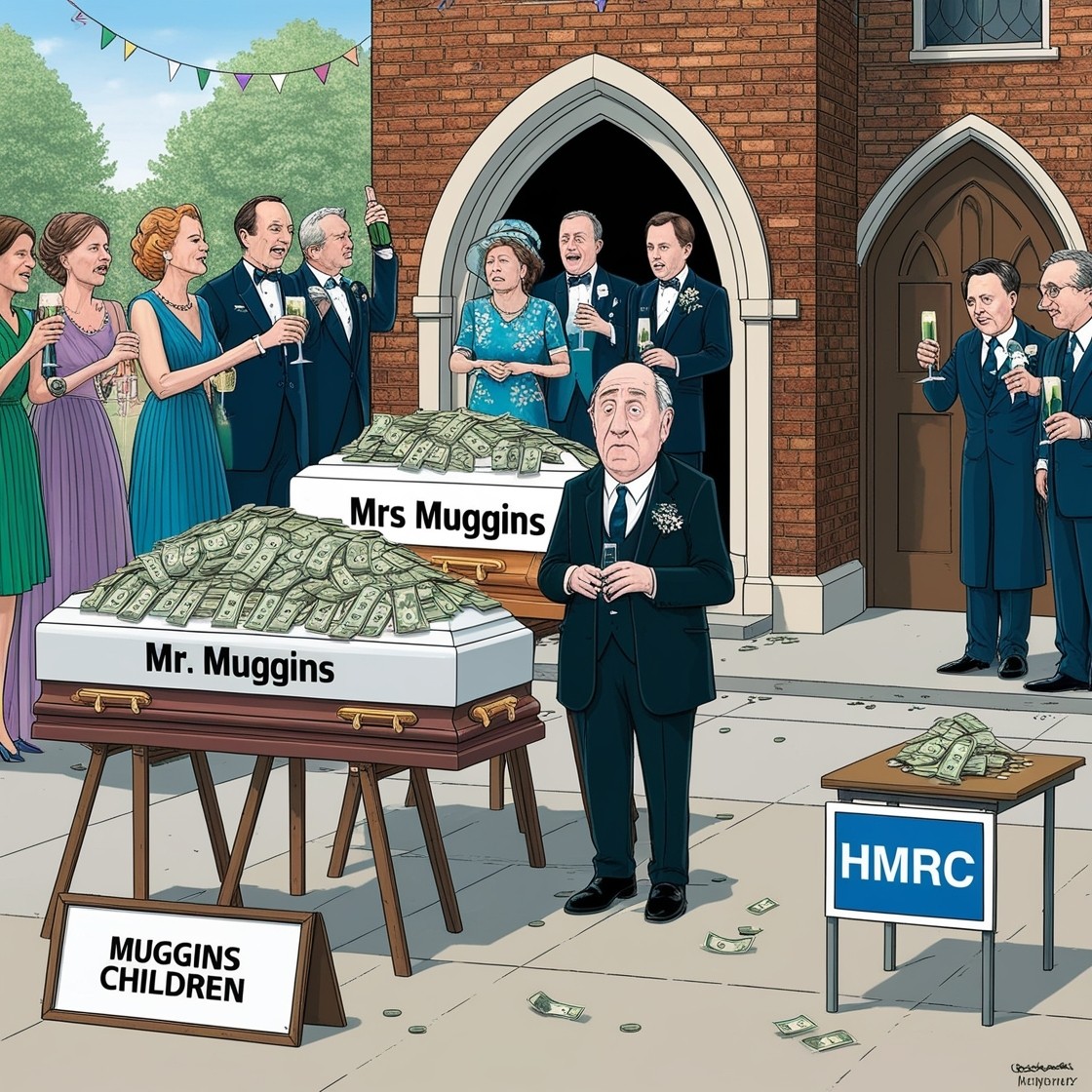

I have, therefore, taken a hypothetical middle-class couple, comfortable but not rich, as an example to show the various (legal) devices currently allowed by the KKK’s extraction goons, the HMRC mob.

Mrs and Mrs Muggins (MMM) have worked hard all their lives, have never been a burden to the State, but now feel unloved (to say the least) and under threat from the said Kleptomaniac Kakistocrats. They are getting on a bit; he a 70-ish retired business man, she a 65-ish former teacher, who have been horrified to learn that their children will be forced to pay the KKK £1,300,00 (at 40%) when the last one of them passes away, before probate is issued and they can get whatever has not already been stolen.

MMM have a combined income at the moment of about £50K, made of pension and rental income. Yes, gentle reader, MMM are ‘greedy landlords’ and so, according to the KKK, deserving of everything they get. The have lived in the same house all their married lives, in the middle of the countryside, down a potholed lane down which trundles, if they are lucky, a dustbin van once a week. They suffer regular blackouts ‘to save the planet’ from their selfish desire to stay warm and keep the lights on. Their house, bought over 40 years ago, is now worth about £1,500 million.

Needless to say, council tax is their biggest single item of expenditure, and the cost of government, from which they get little but problems, dwarves all other items of household expenditure.

They have three investment properties, worth in total about £900,000, which give a net yield in income of less than 3%. They have cash savings and stocks and shares ISAs worth about £1.25 million and a combined pension pot of about £550,000, to give total assets excluding pensions – which are outside the IHT scam – about £4 mill.

And so, recently, spurred on by all the talk of the much richer Labour champagne socialist, living off freebies, extravagant expenses and with gold plated pensions to look forward to, robbing the ‘rich’ to give to the very much richer, they decided to actually do what they’ve been talking about since they retired – seek advice on ways reduce their IHT liability, maximise pension savings, and, if possible, make their money work harder.

Because of their net value, MMM’s estate exceeds £2m from a residential nil rate band point of view, meaning that assets between £2m and £2.7m are taxed, in effect, at 60% for IHT purposes so that their IHT position is as follows

Base estate (for RNRB purposes) £3,950,000

Less available Nil Rate Bands £650,000

Taxable estate £3,300,000

Inheritance tax at 40% £1,320,000

Estate after tax £1,980,000

Total beneficiaries, ex pensions £2,630,000

Plus pension assets £550,000

Grand total to beneficiaries £3,180,000

However – there is always a however, with the KKK, If the value of MMM’s estate grows, so their IHT liability grows – for every one pound of growth, the KKK will pocket 40p. The good news is that, for the moment at least, their pensions are outside the IHT catch.

MMM’s liquid wealth is held in savings and investments, which do not provide any strategy for IHT reduction and, of course, their rental properties are very inefficient from an IHT perspective.

So, as minimising IHT is their priority, they are looking at what strategies are available to them. From advice they have received, one such strategy is investing into a Discounted Gift Plan (DGP).

Investing in a DGP means giving your money away, in a trust, to your beneficiaries, in what is perhaps the most efficient means of minimising IHT. That said, it is inflexible and once done, it’s done. You can’t take it out. But it can generate an income stream – tax free – for you for as long as you live. For example, if MMM invested £1 million in a DGP it is estimated that they would receive an income of about £40,000 pa (up to 4% fixed) that does not need to be declared to the robbing HMRC mob. And if they live for seven years the full investment, including any investment growth, would be outside their estate for IHT purposes thus saving MMM’s beneficiaries £400,000 immediately, without the need for probate.

In addition or alternatively, MMM can invest in a Loan Plan (LP) that gives them access to their capital, provides – potentially – income and IHT savings, and it wouldn’t involve them giving their money away. An LP would not reduce their current IHT liability, but it would stop it getting worse, as LP trust ensures that any growth remains outside of your estate for IHT purposes by giving it away making it available to their beneficiaries without the need for probate and free of IHT. The value of the initial loans is liable for IHT. MMM would have the option of taking a tax-free annual income of 4% of the original value of their investment but also have the option of recovering the loan at any time.

MMM’s money, should they decide on one of these trusts, would be invested in an investment bond, specially designed as a non-income producing asset, so with no need for declaration it in annual tax return. No capital gains tax is applied either. Of course there will be fund manager’s charges, in the region of 1.75% annually, and like all investments the value can drop. Mr and Mrs Muggins really do need to take further special specialist advice, always bearing in mind the age-old advice caveat emptor.

Finally, MMM would be best advised, from an IHT point of view, to sell their rental properties at an appropriate time as their heirs will be hit with a very large IHT bill for them if they don’t.

Tom Armstrong